s corp dividend tax calculator

With Social Security at 124 and Medicare at 29 Self-Employment is a major cost of 153 right off the top before theres any income taxes paid. If the income is considered capital gains or dividends you would pay a lower tax rate ranging from 0 percent to 20 percent.

PAyroll taxes paid as an s-corporation With a salary of and a dividend of.

. 75 of Dividend Income for income within the Basic Rate band. Our S Corp vs. Dividends are paid by C corporations after net income is calculated and taxed.

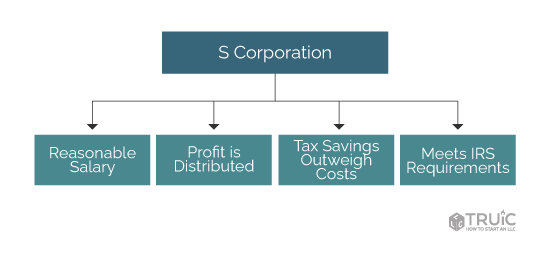

S Corporation Tax Savings Calculator If youre a sole proprietor and reeling at the amount of self-employment and income tax you pay it may be time to review your business status. Income is taxed only once when the income is earned by the S corporation whether the income is reinvested or distributed. Choosing to file as an S Corporation may be financially advantageous and help save money on taxes.

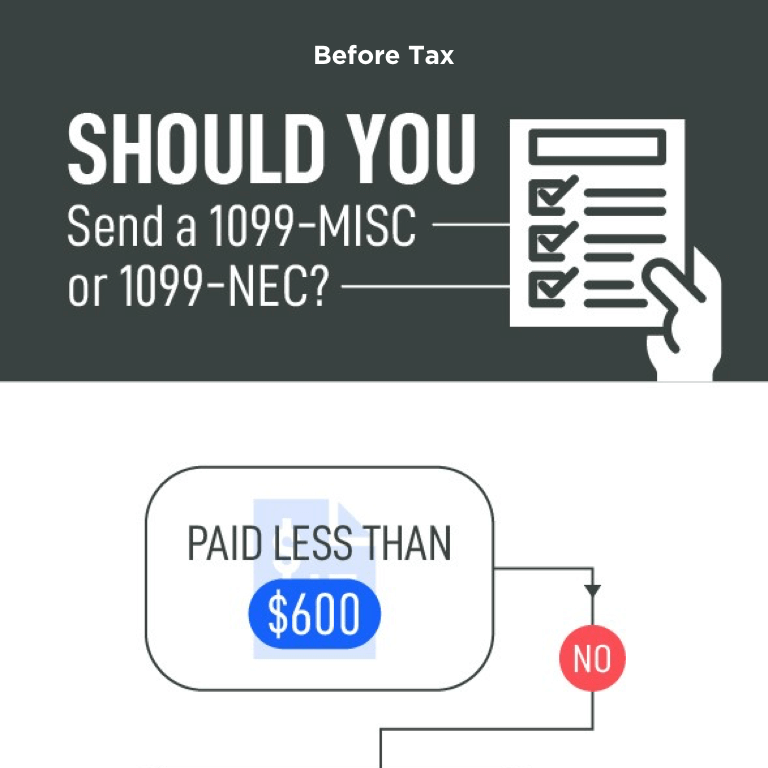

The leftover funds are distributed as dividends which are taxed again on the individual shareholders personal income tax return. From 6 April 2018 the Dividend Allowance reduced to 2000. 1 Select an answer for each question below and we will calculate your S-corp tax savings.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. If an S corp allocates 125000 profit to you the shareholder the character of such income is important. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status.

This application calculates the federal income tax of the founders and company the California state franchise tax and fees the self-employment tax for LLCs and S-Corps pass-through deductions. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship. There is no longer a 10 notional tax credit and an allowance of 5000 tax free dividend allowance has been added to the system.

Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. Normally these taxes are withheld by your employer. Say for example that you get 125000 of income from an S corporation.

Taxability of Social Security Benefits. If income is standard income you would pay the standard income tax rates. Ad Taxfyle solves all of your tax needs by connecting you w a US-based licensed CPA pro.

Ad We Simplify The Process And Keep It Industry-Specific So You Can File Taxes w Confidence. The income brackets for them are generally adjusted each. By Tatiana Loughman EA 888 786-9829 Docket No.

AS a sole proprietor Self Employment Taxes paid as a Sole Proprietor. The biggest difference is the tax rates instead of the usual 20 40 45 depending on your tax band youll be taxed at 75 325 and 381. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3.

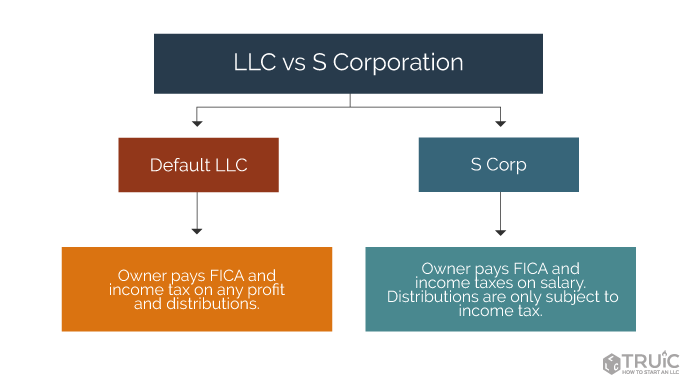

This tax calculator shows these values at the top of. S Corporations reduce your taxes by lessening the amount of payroll or self-employment tax you pay. S Corps create tremendous savings because they reduce the biggest expense many LLC owners face.

Dividend Tax Rates for the 2021 Tax Year Just like other investment income dividends can be subject to better tax rates than other forms of income if theyre qualified in the eyes of the IRS. The SE tax rate for business owners is 153 tax of the first 142800 of income and 29 of everything over 142800. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

How an S Corporation Saves You Money. An S corporation is not subject to corporate tax. The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the rest being taken as a distribution It will then show you how much money you can save in taxes.

LLC Calculator guide will explain how to tell whether an S corp. How your dividend tax is calculated. But if the income is long-term capital gains or qualified dividends you pay the lower preferential tax rates sometimes 0 usually 15 and worst-case 20.

Being Taxed as an S-Corp Versus LLC. 2022-02-23 As a pass-through entity S corporations distribute their earnings through the payment of dividends to shareholders which are only taxed at the shareholder level. How S Corps Create Savings.

Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed. S Corporation Distributions. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax.

The tax rate on nonqualified dividends is the same as your regular income tax bracket. The S Corp Tax Calculator. S corp status also allows business owners to be treated as employees of the business for tax purposes which can result in tax savings.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. However if you elect to be taxed as an S-Corporation and take a 40000 salary with the remaining 30000 being a distribution to you or you keep it in the business you pay only. Tax on dividends is calculated pretty much the same way as tax on any other income.

Plug In To The Worlds Largest On-Demand Domestic Accounting Workforce. Money that you take out as a distribution is not subject to the 153 percent payroll or self-employment tax whereas your. Because an S corporation is not taxed on these profits as corporate income it avoids.

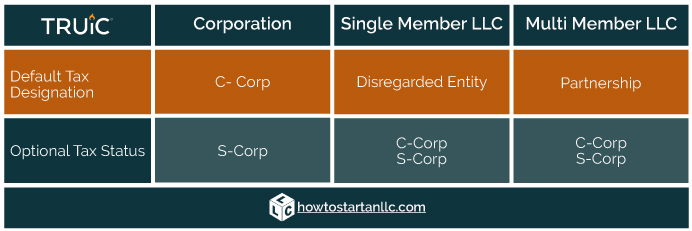

The dividend tax rates for dividends that exceed the set allowance are. An S corporation S corp is a tax status under Subchapter S of the IRS tax code that you can elect for your limited liability company or corporation. 13970-19 December 6 2021 US Tax Court petitioner resided in Colorado and filed her petition with the court in order to issue.

50000 of ordinary business profits. Just complete the fields below with your best estimates and then register to get your CPA or schedule a free Consultation here. If the income is ordinary income you pay the ordinary income tax rates.

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Vs Llc Difference Between Llc And S Corp Truic

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

Effective Tax Rate Formula Calculator Excel Template

S Corp Vs Llc Calculator Truic

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Rate What Is The S Corp Tax Rate Truic

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg Brokers Service Marketing Group

S Corporation Income Tax Calculator S Corp Calculator

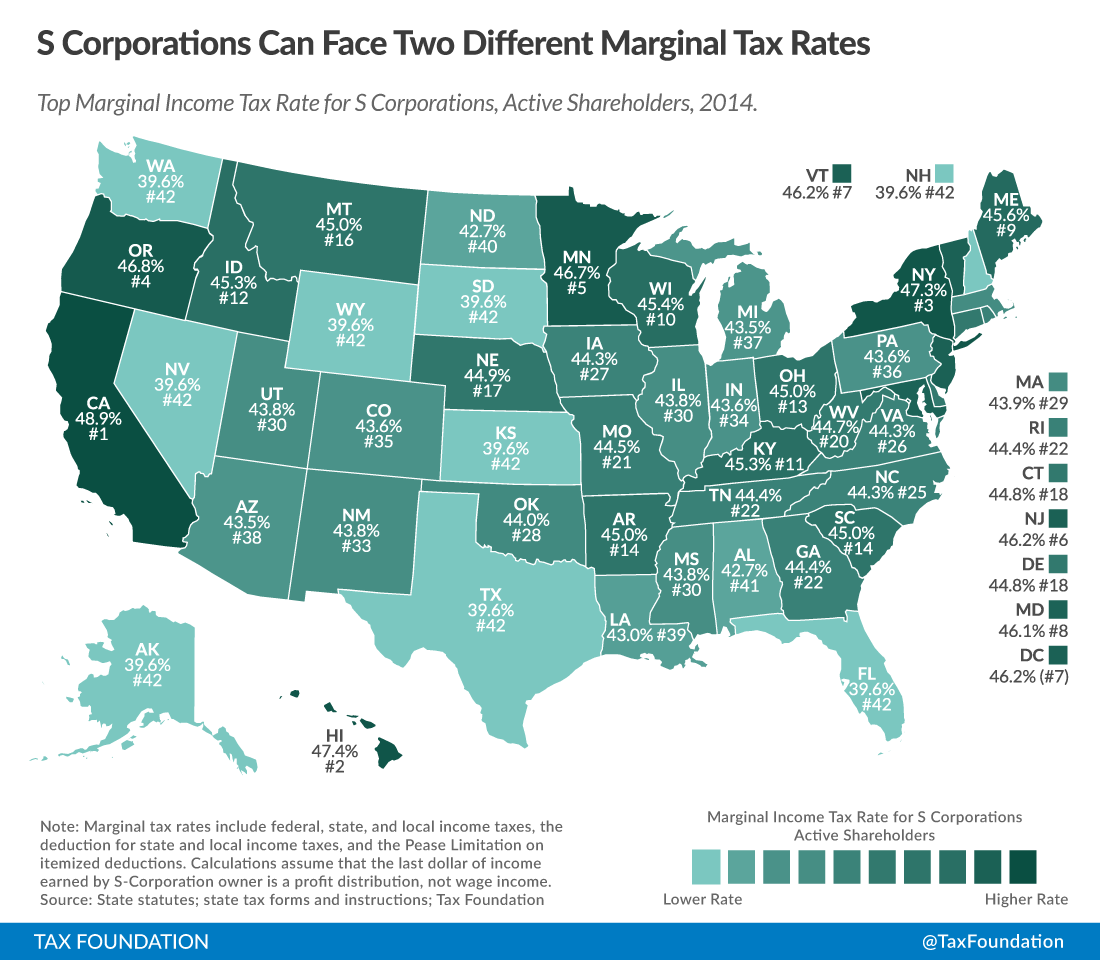

The Dual Tax Burden Of S Corporations Tax Foundation

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

Dividend Tax Rates In 2021 And 2022 The Motley Fool

What Is An S Corporation What Is An S Corp Truic

S Corp Tax Rate What Is The S Corp Tax Rate Truic

S Corp Tax Calculator Llc Vs C Corp Vs S Corp